Managing money starts in the maths classroom

Discover our resources to help students develop financial literacy

15/05/2025

This year’s National Numeracy Day theme, The Money Edition, is a perfect chance to explore how maths connects to real life. In this feature, the NCETM’s Becky Donaldson shares how NCETM Checkpoints can be used to spark discussions around money, helping students to build confidence with key financial ideas.

With one third of young people and adults stating that managing their money better is an incentive to improve maths numeracy, there is no better time to think about money in the maths classroom. But ‘money maths’ doesn’t need to be an add-on. We’ve gathered some ideas from our existing materials (with a sneak peek at some soon-to-be published materials!) to show how financial literacy can be embedded into everyday maths lessons.

Much of the mathematical knowledge that underpins strong money skills can already be found in the school curriculum, and so there are ample opportunities to use realistic finance contexts. Multiplicative reasoning is key to much of what students will need for being confident with finances in their future – from making savvy choices about purchases, to understanding take-home pay, to choosing the best mortgage or savings deal. In the Year 7 or 8 classroom, some of these situations can feel very ‘grown up’ and distant to students, so it’s important to use age-appropriate situations that still contextualise these important skills.

Within our NCETM Checkpoints materials, there are several activities that can provide an opportunity to talk about money whilst embedding understanding about multiplicative structure.

Year 7 activities

The following three examples are taken from the Year 7 deck ‘Understanding Multiplicative Relationships: fractions and ratio’. Download it if you haven’t already.

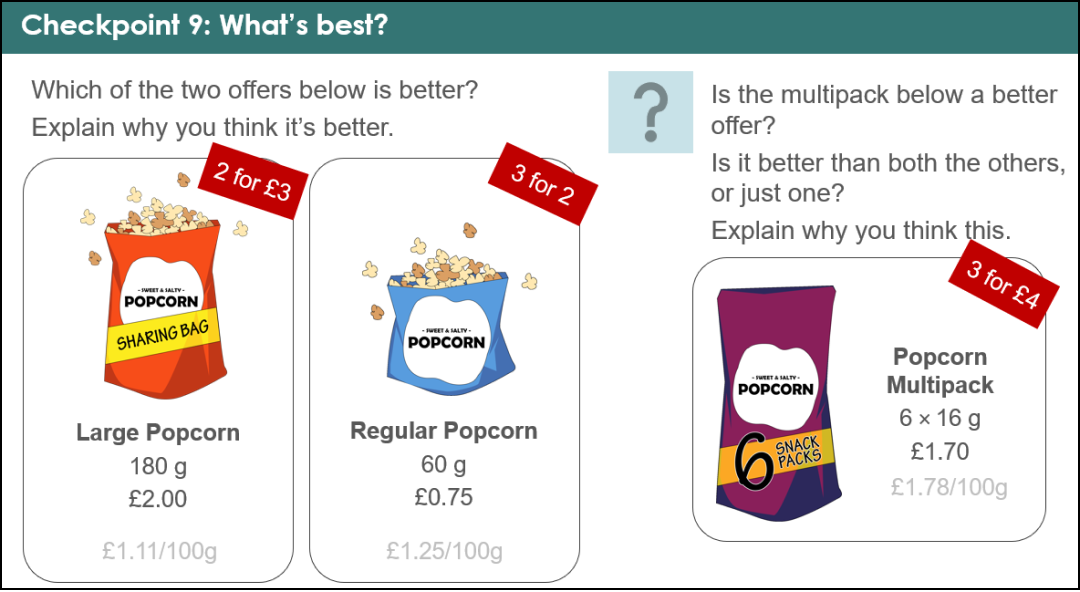

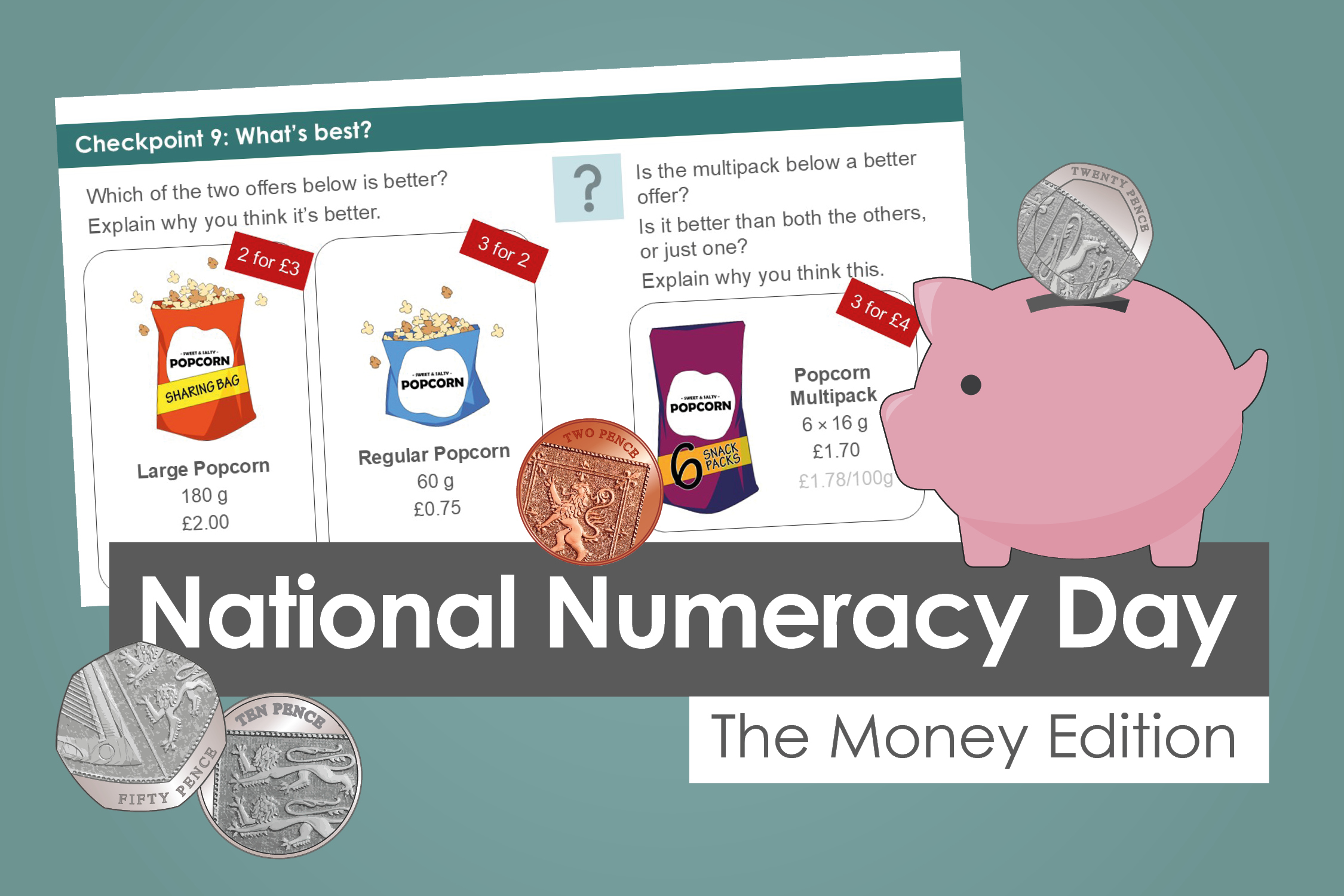

Checkpoint 9 takes a classic ‘best buy’ situation but presents it exactly as students might see it on a label in the supermarket or an online shop (tap/click image to enlarge):

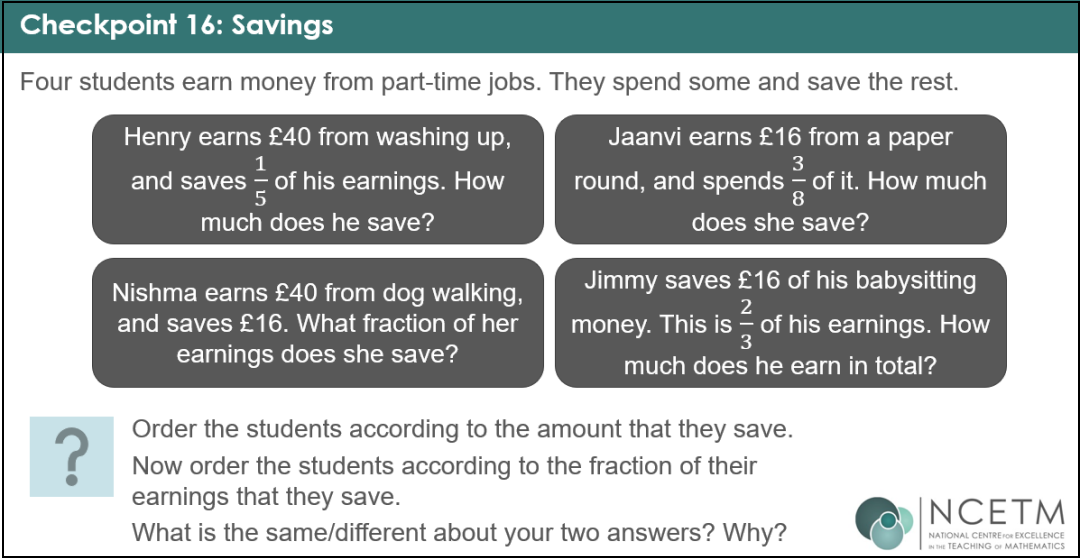

Checkpoint 16 also tackles financial literacy, and is an opportunity for students to work with questions posed as worded fractions of an amount. The context will be familiar: savings from the kind of part-time jobs students themselves might seek out before they leave school.

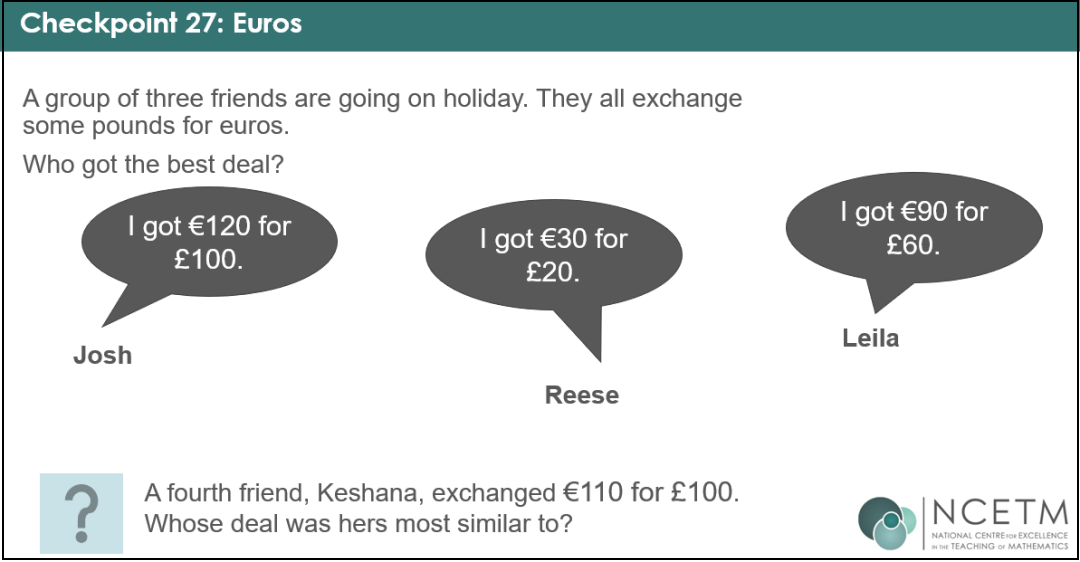

Checkpoint 27 looks at exchange rates. The slides include teacher notes which suggest representations such as lists of multiples or double number lines, to support students to recognise that the maths involved should be readily familiar to them:

Year 8 activities

A deep and connected understanding of percentages is particularly helpful and – with the right prompts – can also teach students about managing finances. The following two examples are from the Year 8 deck ‘Understanding multiplicative relationships, percentages and proportionality’. Again, make sure you’ve downloaded it and taken a look at the slides with activities and teacher notes.

Both the tasks below could provide opportunities to sow the seeds for future knowledge around interest rates and making sound financial decisions.

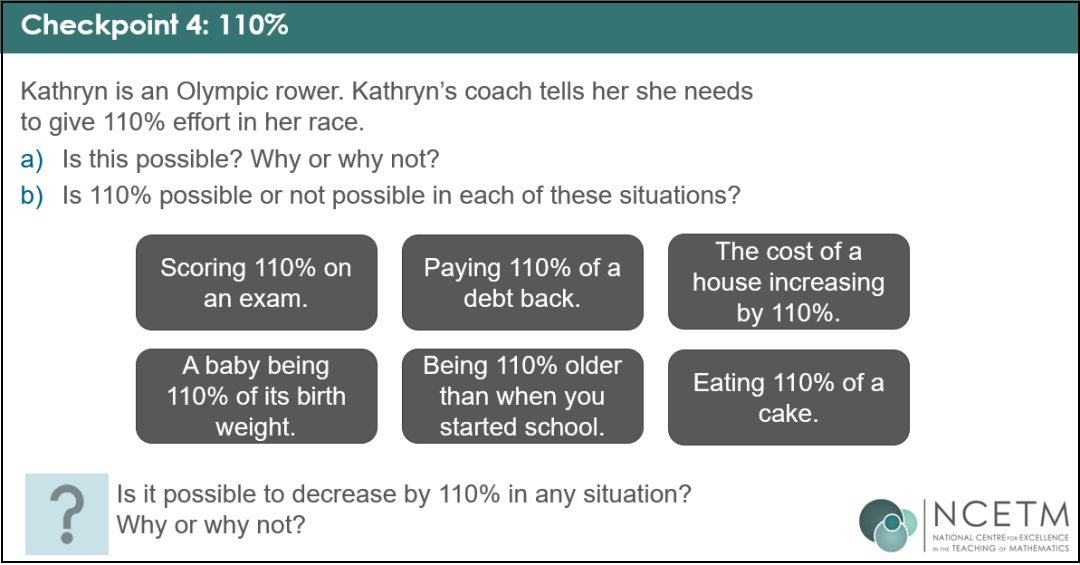

Checkpoint 4 looks at whether something is “110%” possible in different situations. Some of the scenarios could be the springboard for rich conversations about debt and house prices:

Checkpoint 13 reminds students that a small percentage can be a bigger absolute value, depending on the amount of the ‘whole’ – in this case, using the context of earnings:

As students get older, they will gain a lot from hearing some of the language that they will need in order to understand things like income, tax and interest. In our upcoming KS4 Professional Development Materials, Theme 10 explores statistics and probability. The focus of the following example will be box plots, but it is also an opportunity to introduce some key financial vocabulary:

“Keir and Eluned are comparing how much money people earn in their local areas. They find some data about the average net annual income, which is the amount of money earned in a year, after tax has been taken.”

Using the language commonly found on payslips and P60s, with simple explanations, can help familiarise students with the terminology that they will need to know when they enter the workplace.

Finance in your department’s curriculum

If you were to discuss the tasks above with your team in department time, what would your colleagues think? Do teachers shy away from moments where they can educate students about everyday finances, or do they embrace them?

What other opportunities could you find within your curriculum to ensure students experience realistic and meaningful financial contexts? Do you make students aware of how relevant different aspects of their maths learning are for managing their finances?

Teachers may never know how much impact they have on students’ future confidence with all things finance, but that doesn’t mean they shouldn’t make the most of ‘money moments’ when they arise.

Download Checkpoints now

Explore hundreds of KS3 diagnostic activities including several with a financial focus

Explore