Teaching that adds up: how mastery can support financial literacy

Bringing a teaching for mastery lens to Oak’s financial education resources across the primary and secondary phases

20/05/2025

To mark National Numeracy Day’s Money Edition, the NCETM’s Paul Rowlandson explores Oak National Academy’s financial education resources—and how they can support teachers in developing pupils’ confidence with money, maths and real-life decision-making across the primary and secondary years.

This year’s National Numeracy Day on money is a timely reminder that high-quality maths education isn’t just about passing exams – it’s about giving young people the tools they need to make confident, informed financial decisions in everyday life. Whether it's understanding tax, making choices about saving, or spotting the best value at the supermarket, numeracy plays a big role in how we manage money day-to-day.

In my work across both MEI and the NCETM, I’ve had the chance to explore this from a few different angles. One recent project I was involved in, as part of my role at MEI, was the creation of a new suite of financial literacy lessons now hosted by Oak National Academy. These were designed by teachers, for teachers – spanning Years 1 to 11 – and focus on helping students develop the confidence to use maths in meaningful, real-world contexts.

At the same time, I’m constantly thinking about how the Five Big Ideas in Teaching for Mastery can support this kind of learning. And in the case of these lessons, the link is particularly strong.

What are these lessons and how do they work?

There are 47 lessons in total, tailored to different key stages. They are designed around core issues in personal finance: saving, borrowing, budgeting, inflation, payslips, bank statements and more.

What makes these lessons a bit different from traditional maths teaching is that they start from the context. Rather than selecting a mathematical concept first (say, percentages) and then wrapping a financial problem around it, these lessons begin with the real-life issue – like understanding a payslip or comparing borrowing options – and then introduce the maths that supports the decision making.

For example, ‘borrowing and saving’ appears at multiple key stages. For younger students, it might involve borrowing money from a family member and repaying it in one go. Older students explore longer-term borrowing, loans and calculating compound interest or APR. The lesson content scales with age, both in mathematical sophistication and in context.

Click/tap image to enlarge

Each lesson includes:

- a starter quiz

- fully editable PowerPoint slides

- worksheets

- an exit quiz

- accompanying teacher notes, including objectives, key words and common misconceptions.

They’ve been designed by teachers with deep knowledge of teaching for mastery, including some who’ve been Mastery Specialists themselves, so you’ll see that influence throughout.

Teaching financial literacy feels different – and that’s the point

Personally, I think teaching one of these lessons feels a bit more like teaching economics or accountancy than traditional maths. That’s not to say it lacks rigour –students are still performing calculations in every lesson – but the maths is there to serve a purpose. It’s about using numbers to inform decisions, rather than finding one right answer.

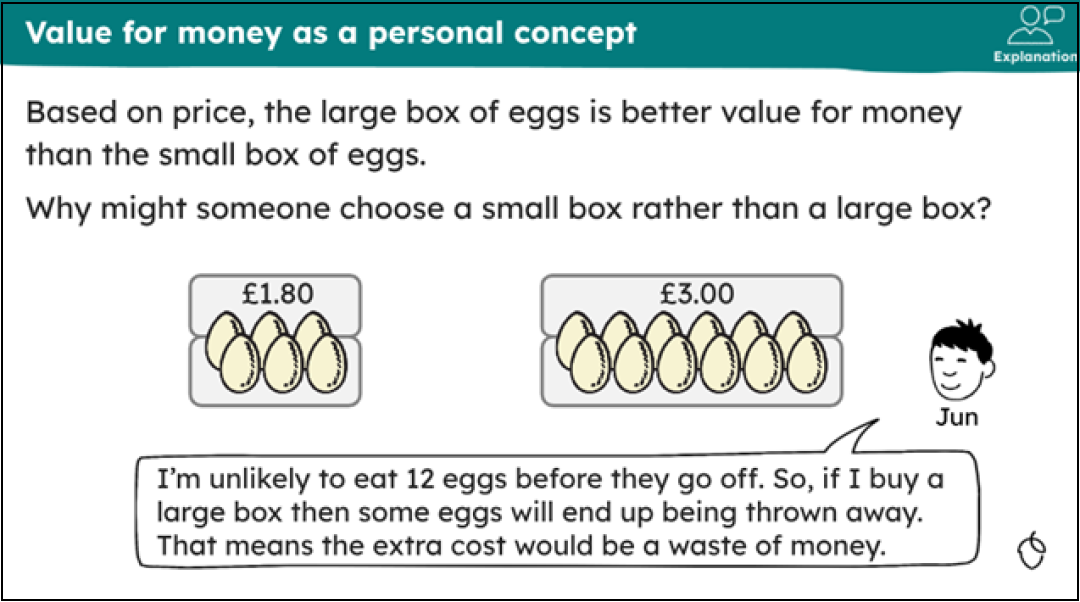

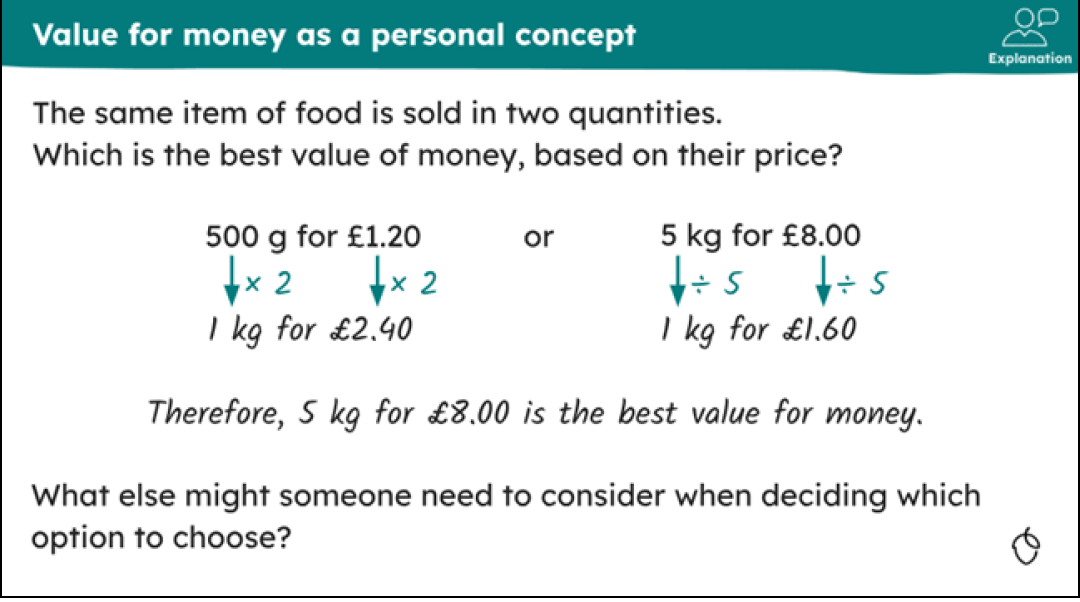

Take the example of comparing the price of a box of six eggs to a box of 12. Mathematically, the 12-pack may be better value per egg, but if you know they’ll go off before they’re used then it becomes a waste of money. That kind of reasoning, based on context, not just calculation, is at the heart of financial confidence.

The Five Big Ideas in action

Here’s how the financial literacy lessons reflect the Five Big Ideas in Teaching for Mastery in practice:

- Coherence

Each lesson builds carefully on prior knowledge. The starter quiz activates what students already know, and each step of the lesson builds logically from the last. Across the series, concepts like saving, borrowing and budgeting evolve from simple beginnings into more complex decision-making frameworks. - Fluency

Students do a lot of calculation, but it’s not about speed or repetition. It’s about being able to select the right method for the situation and using it flexibly. That’s real fluency: knowing when and how to apply knowledge, especially in unfamiliar or practical contexts. - Mathematical Thinking

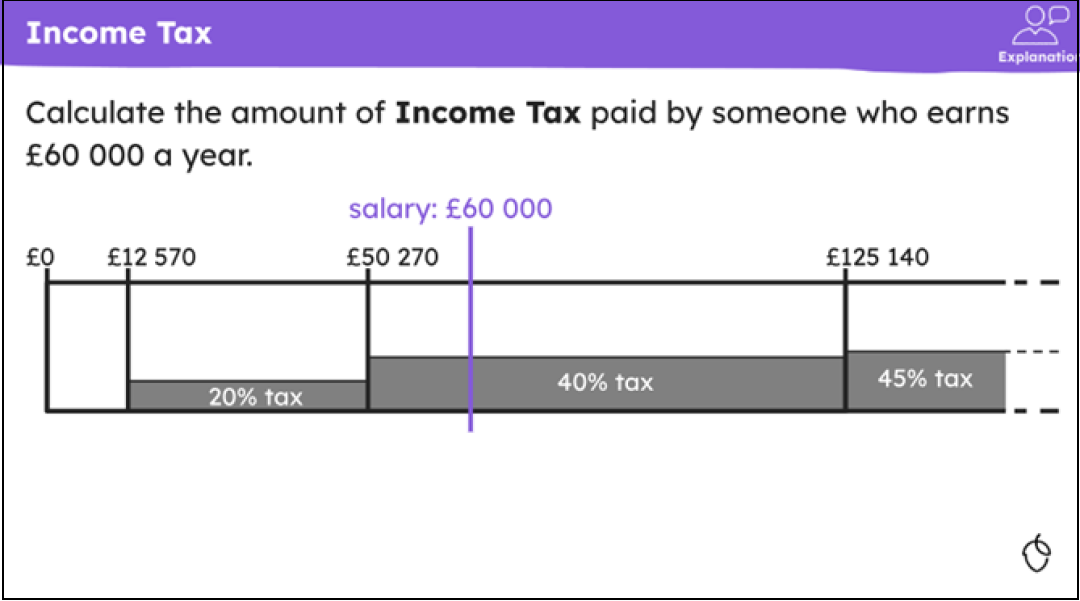

The lessons encourage students to reflect, reason and justify. There often isn’t one correct answer – particularly in topics like budgeting or assessing risk. Students are invited to consider different options and explain their thinking. It’s this kind of open discussion that builds maturity in mathematical thinking. - Representation and Structure

The lessons make strong use of visual and structural representations to support understanding. Whether it’s comparing interest rates, calculating with percentages, or analysing tax bands, the use of models helps to make the abstract concept much more tangible. - Variation

Key ideas are explored through multiple examples and scenarios. This helps students to deepen their understanding and see where and why a particular approach works, or doesn’t. For instance, exploring when borrowing might be sensible versus risky gives students a more nuanced view of personal finance.

Why this matters for students and teachers

One of the big takeaways from developing these materials is that they’re not just about learning how to do something. They’re about understanding why it matters. In many ways, these lessons show what’s possible when we apply a teaching for mastery approach beyond the traditional curriculum. The aim is to help students feel confident in using maths to make decisions that affect their lives now and in the future.

And they’re equally empowering for teachers. These aren’t dry, bolt-on PSHE sessions! They’re rich, structured and rooted in the kind of deep mathematical thinking we want to encourage across the curriculum. They sit well alongside the core curriculum and can complement what’s already being taught.

Final thoughts

Financial literacy isn’t a luxury. It’s a necessity. And maths education has a vital role to play in equipping students with the tools they need to navigate that world with confidence.

These Oak lessons, developed by teachers who understand both maths and mastery, offer one practical way in. And the principles of teaching for mastery provide a framework for making sure the learning is deep, lasting and transferable.

If you’re curious, I’d encourage you to explore the lessons. Try one out. See how your students respond. And if it sparks conversations about real-world maths, personal choices, or long-term thinking, all the better.

Get involved

- CONNECT: with your local Maths Hub to discover more about teaching for mastery.

- DISCOVER: the new financial education materials at Oak National Academy for KS1, KS2, KS3 and KS4.

- EXPLORE: the Five Big Ideas in Teaching for Mastery at primary and secondary with our series of features and videos.

Contains public sector information licensed under the Open Government Licence v3.0. Original materials created by MEI and published by Oak National Academy.